FHA Mortgages

We believe that everyone deserves the opportunity to own a home, regardless of their financial situation. Thomaston Savings Bank is proud to offer Federal Housing Administration (FHA)1 mortgage options, making the dream of homeownership accessible for more borrowers. Qualified individuals benefit from a low down payment, a competitive low rate, and lower credit requirements. Add in the hands-on support from a team of local lending experts, and your dream of homeownership is closer than you think! Whether you're purchasing a new home or refinancing an existing mortgage, our commitment is to help you achieve your goals!

FHA Mortgage Highlights

Low down payments: With a down payment requirement as low as 3.5%, FHA mortgages can make homeownership more affordable for you from the start.

Easier credit qualifying: Because FHA mortgages have more flexible credit requirements than conventional mortgages, you may still qualify even if you have a lower credit score.

100% gift fund allowable:2 FHA mortgages allow you to use gift funds to cover the entire down payment and closing costs, which can provide a big boost toward owning a new home.

Closing cost credit: Sellers can contribute up to 6% of the purchase price towards your closing costs with an FHA mortgage.

HUD Approved Lender: We're able to offer more competitive rates and terms than other lenders because we're backed by the government.

Local expertise: Our lending experts are based in the same area as you, so they have a deep understanding of the local market and can provide prompt personalized support.

Qualifying for a Home Loan

Consider these factors so that you can be prepared to apply for a home loan.

Meet the Team

Contact one of our mortgage loan officers today.

Jason Alldredge

NMLS ID 457926

Work: 860-283-3441

Mobile: 203-558-0290

Vania Guerrera

NMLS ID 457927

Work: 860-283-3487

Mobile: 203-525-0364

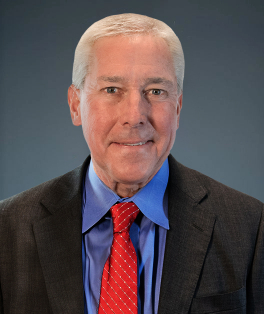

Bob Frazee

NMLS ID 103851

Work: 860-283-3406

Mobile: 860-559-0353

Gary Margelot

NMLS ID 555699

Work: 860-283-3489

Mobile: 203-910-6892

Ready to Get Started?

Fill out the form below to get in touch and find out more about our FHA Mortgages.

1 FHA Borrowers need to meet certain guidelines to qualify, including income and credit requirements.

2The minimum down payment required is 3.5% and can be gifted to the buyer from a relative, an employer, an approved charitable group, or a government homebuyer program.